Effects

ABM Finance is a constructor for managing the efficiency of any business and automating the financial management system

of data collection up to

for payment on Telegram

We help businesses automate their financial system

Agribusiness

Development and construction

Pharmaceuticals

Food & Beverages

Media

Transport and logistics

Functions of the financial management system

Budgeting

Treasury

Managerial accounting

Сonsolidation IFRS

Balance

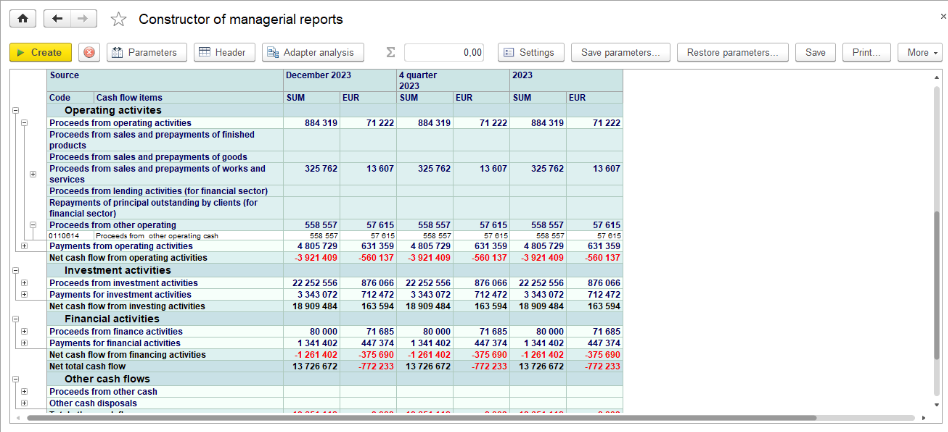

Cashflow

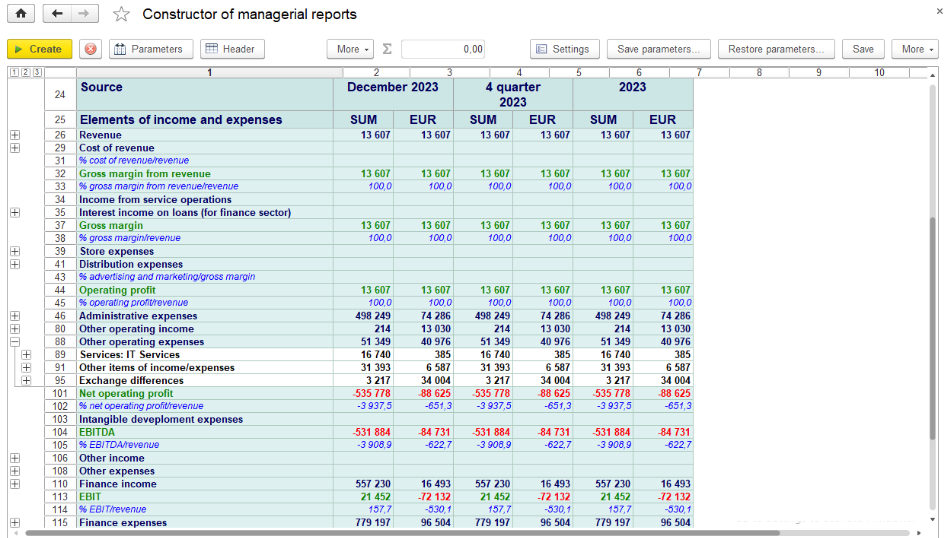

P&L

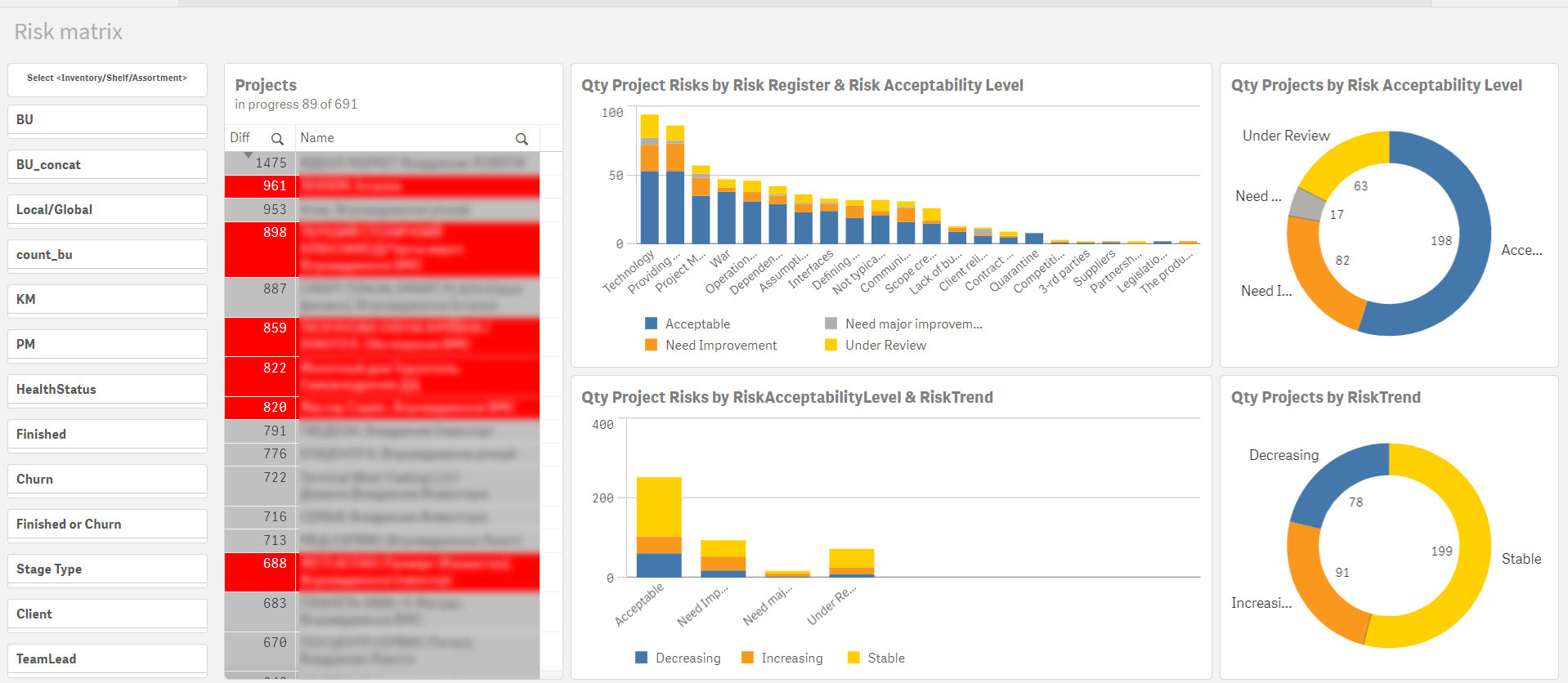

Project financial management

-

Multi-scenario budgeting

Flexible budgeting with the ability to quickly change the scenario in 1 day.

Compare an unlimited number of scenarios. -

Planning across all financial reporting centres in one system

Implemented through functional budgets with minimal labour and time costs.

-

Financial management system of the company

Transparent and audited plan-fact reporting with the ability to fail in the original document.

Motivation of business unit managers to meet their financial targets.

-

Methodology for operational cash flow management

Development of the approval process, documents for application, registry structure, architecture of docking with client banks.

-

The process of cash payment requests

Automation of the submission, coordination, and approval of requests for the payment of money.

Automated financial management system allows you to approve money requests on Telegram in 1 minute anywhere in the world. -

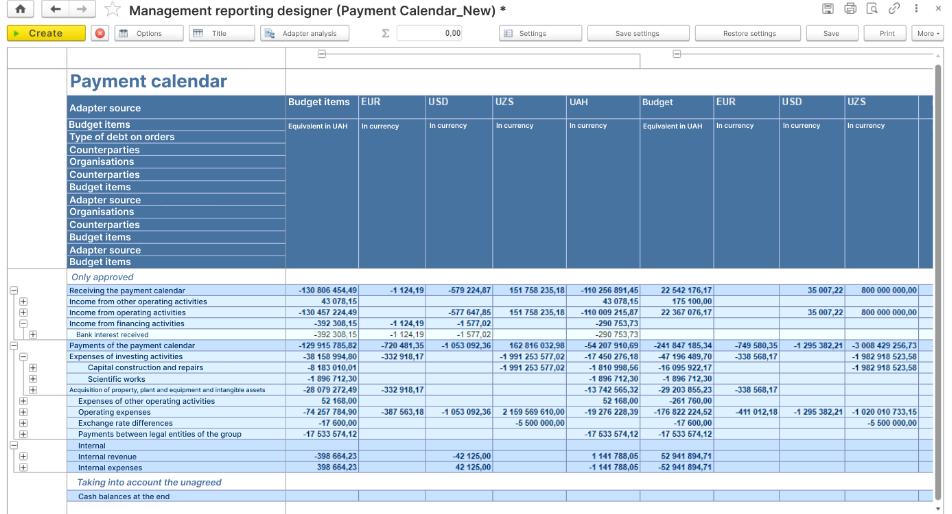

Automatic payment calendar

Payment calendar with planning of receipts/payments and management of cash gaps by groups of companies or by individual business lines.

-

Management accounting policies

Development of management accounting policies and a management chart of accounts.

-

Transparent reporting for top management

Creation of regulations on reporting forms for Cash Flow, PL, Balance, Capex – the main instruments of financial management.

Setting up an individual reporting system online with the ability to drill down to the source document. -

Perfect planning and forecasting

Control of key financial indicators helps to reduce risks and ensure the stability of the company. The analysis of trends and all influencing factors allows algorithms to predict potential developments in the market.

-

Consolidation of accounting data

Establishing a single central hub for data consolidation. Unification of accounting policies and accounting directories. Development of rules for transferring events and synchronisation of accounting directories from different sources.

-

Data transformation

Formation of registers and directories to reflect the rules of mapping accounting data to the IFRS chart of accounts.

-

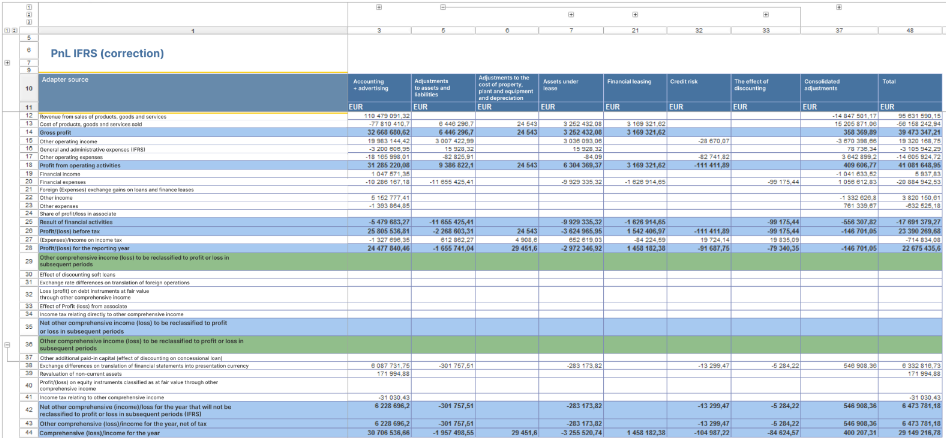

Automation of labour-intensive adjustments

Creation of mechanisms to perform automatic adjustments of data for IFRS purposes – removal of intragroup eliminations, non-current assets and liabilities discounting, revaluation of fixed assets events, calculation of deferred tax liabilities, etc.

-

Building an IFRS reporting package

Automation of IFRS reporting package generation in both local and consolidated formats, including Balance, CashFlow indirect, P&L, Capex, and required disclosures.

-

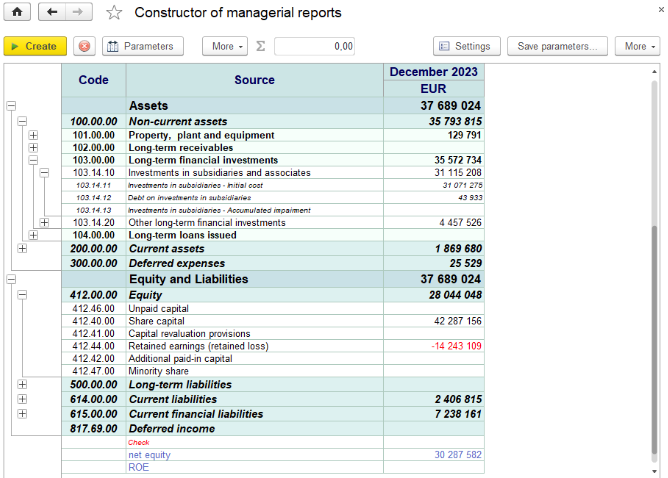

Control

This feature checks the correctness of the statement in terms of cash flows, income and expenses. As well as the company's net working capital: the difference between liquid assets and term liabilities.

-

Analyses

Analyses shows assets (information about all the company's property), liabilities (grouped by maturity), and shareholders' equity.

-

Online analytics

Actual cash flow statements are available online with the ability to go through to the original document and cash application.

-

Efficient analysis and accounting

Indicators of the direction of cash flows, the amount of specific payments and receipts. As well as

cash turnover for the period (with the required periodicity), in addition to the balance of cash on hand and in accounts as of specific dates. -

Management of the company's solvency

ABM Finance helps to maintain the necessary amount of cash in the account to make all scheduled payments and avoid cash gaps. It reduces the level of temporarily unused resources.

-

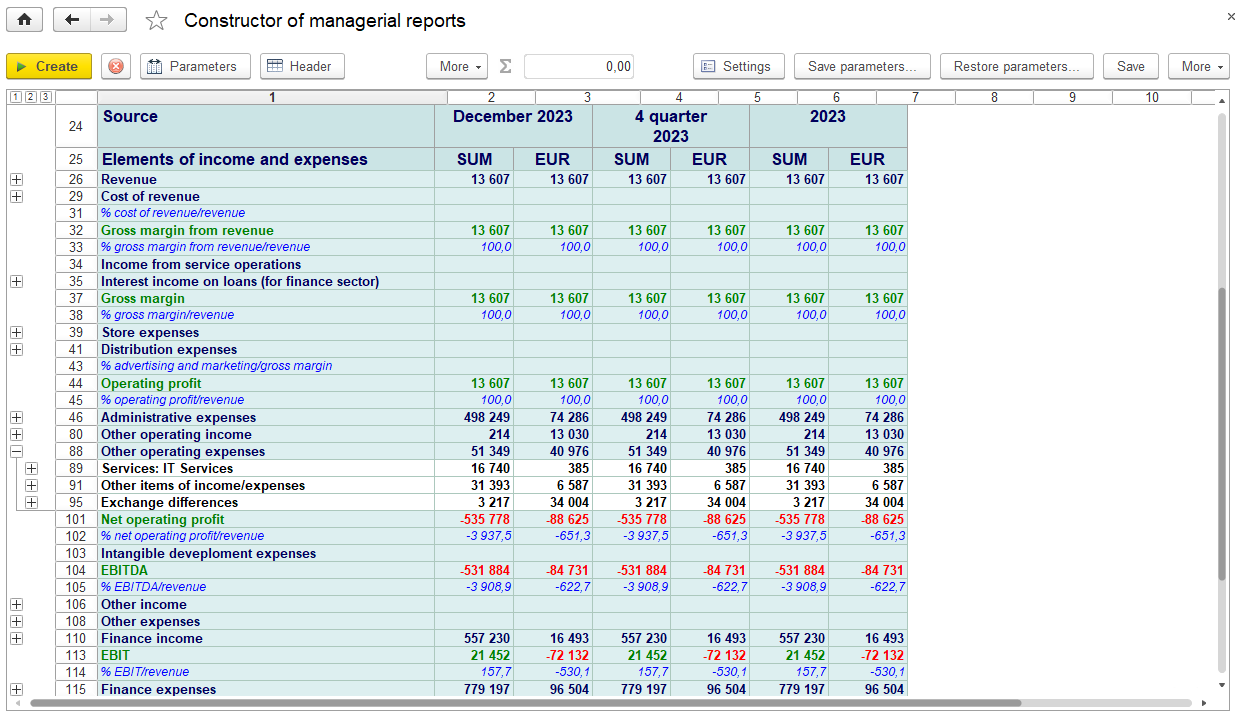

Evaluation of the company's operations

It calculates the company's income-to-expense ratio for the period, revealing the efficiency (profitability) of operations, the sources of revenue, and the amount of profit generated.

-

Comprehensive online analytics

Real-time analytics across all business lines provide insights into company profits and losses, with the capability to look into the original data for detailed examination.

-

Analytical cross sections

Revenue and Expenditure Budget Item, Nomenclature Group, Project, Object, etc.

-

Time management

Planning, adjusting and checking project timelines.

-

Management of resources and contractors

Planning, adjusting and checking the execution of work and resource expenditure.

-

Management of cost of operations

Planning, adjusting and checking the cost of projects (facilities), as well as investment management.

Results of using ABM Finance

An automated financial management system increases business efficiency many times over

-

Single financial management methodology

-

Flexible multi-scenario budgeting

-

Audited and timely financial statements

-

Plan-factual analysis of key business KPIs

-

80% faster reporting for management and investors

-

A fully-prepared information system, ready to support business scaling

-

Consolidated СashFlow, P&L, Balance reports

Project implementation

Development of financial structure and management accounting policy. Description of budgeting business processes, harmonisation of requests. Description of security requirements and tools.

01 Express diagnostics

02 Development of the company's financial model

03 Implementation

04 Corporate support

Estimation (Fixed price)

Architecture

Project plan

Development of IT architecture

Development of methodologies

Development of financial structure and management accounting policy. Description of budgeting business processes, harmonisation of requests. Description of security requirements and tools.

Drafting a project charter

Installation

Configuring ABM Finance

Project launch

Support

Refinement

System implementation options

ABM Finance

ABM Finance DIY

ABM Finance Project

Who is it for?

Implementation process

Configuration

Licenses

Training

Support

Advantages of implementing ABM Finance

Zero coding

Financial model for any business can be set up without a programmer

Flexible construction

The software architecture facilitates the easy integration of new businesses, sectors, accounting methods, and reporting types.

Product consolidator

The system automatically generates consolidated financial statements for groups of companies and for individual business lines

Frequently asked questions

Is ABM Finance an operational accounting system?

No. ABM Finance is a top-level system that builds and automates management financial accounting processes (budget planning, consolidated management accounting and financial reporting, treasury, IFRS, financial business processes and document flow).

What is the advantage of ABM Finance compared to other systems?

ABM Finance is a flexible constructor that allows you to build any financial model from scratch, of any level of complexity, taking into account the specifics of your company’s financial activities. The system is configured without programmers using the zero coding principle. It can be seamlessly integrated with the accounting system. Generates and consolidates financial statements in real time. Individual approach to each project and each client.

How long does it take to implement the system?

Terms are determined individually and depend on the scale of the company, the specifics of the business, the current state of financial management, the complexity of the financial model, the number of functional blocks of the project, the size and involvement of the client’s project team, etc. The average period is 6-10 months.

Is there any technical support after the project is completed?

Yes. Upon completion of the project, the client can optionally use corporate support services, which provide technical and advisory support.

Is there training for the company's employees?

During the project, we train users at several levels (from employees of financial and economic departments to the highest level of top management). At the client’s request, we also form an ‘internal competence centre’ from the staff to further support and develop the system after the project is completed.

How secure is the system and the data stored in it?

Usually, databases are located in secure cloud storage, and access to the database is provided through authorised access with several levels of verification. As for security in the system itself, the security system is configured according to the customer’s needs. Customisation is possible not only for different system objects, but even for their elements. We have many years of experience in setting up matrix and multi-level security systems, which we will be happy to share in the project.

Is there a monthly fee for the use of licenses?

No, there are no monthly fees for using ABM Finance software licences.

We appreciate you contacting us. One of our specialists will get back in touch with you soon. Have a great day!