4 simple steps to efficient company’s cashflow management

The issue of cashflow management is essential to any company. Despite this, 70% of all enterprises still encounter problems with cash flow, and every fifth claims that this is an ordinary rather than exceptional situation. The main problem is that today you have to pay for the suppliers service with the money that a customer was supposed to transfer on your account yesterday, but an unexpected situation occurred and money would appear at the end of the week. Are you familiar with such situations? I am sure, that you are.

Such situations and problems will always be there, that’s why everything depends on a set of actions that you have undertaken in advance. These actions have one goal: to postpone the time of sending money as much as possible and, at the same time, to work hard to get money.

Today we would like to introduce 4 ways how to achieve the mentioned goals.

1. Calculate and forecast cash flow

Forecast your cash flow for a year, a quarter, a month, and if you have a fast-growing business, do it even for a week. Such scrupulousness will help you to be alert and if something happens, you will act quickly and solve a problem. Also, you should be clearly aware of the fact that money will not always appear at the same speed, and creditworthiness will not expand endlessly.

How to start forecasting?

See how much cash you have now and then continue to collect information. Talk to vendors, service representatives, bank employees and the finance department, asking the right questions: how much money will come in the form of payments, what is the cost of servicing, do we have “bad debts”, etc. In this way, you will accumulate all the information and be able to build a high-quality forecast.

The next step is to create a detailed cash spending plan. This means not only knowing when the liabilities will become due, but also what you will have to pay for. It is important to take into account all significant and minor costs: rent, inventory, salaries, taxes, benefits, equipment costs, professional fees, utilities, office supplies, debt payments, advertising, vehicle maintenance (service and fuel).

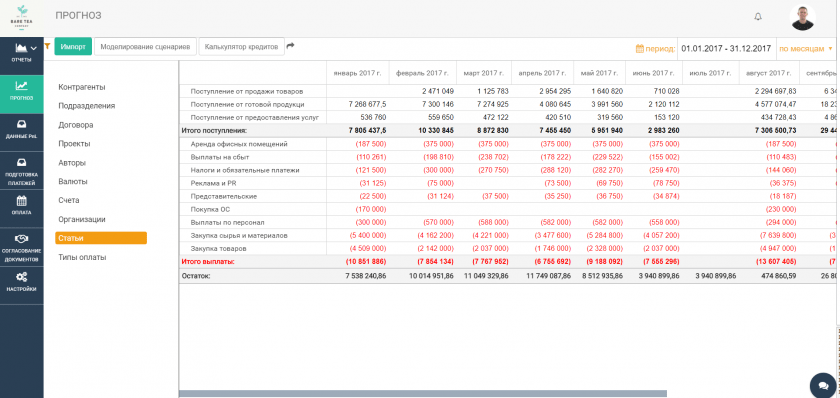

ABM Finance forecasting

2. Build a smart system for receiving funds

If your clients paid you immediately after the service was rendered, you would never have any cash flow problems, but the probability of such an outcome is 0.01%. Therefore, you need to know and perform a set of actions every day that will help you get your money faster:

- offer a discount to customers who pay for services on time;

- ask a customer to make a prepayment at the time of the contract execution;

- check the creditworthiness of new customers;

- issue invoices immediately and track payments that are slow.

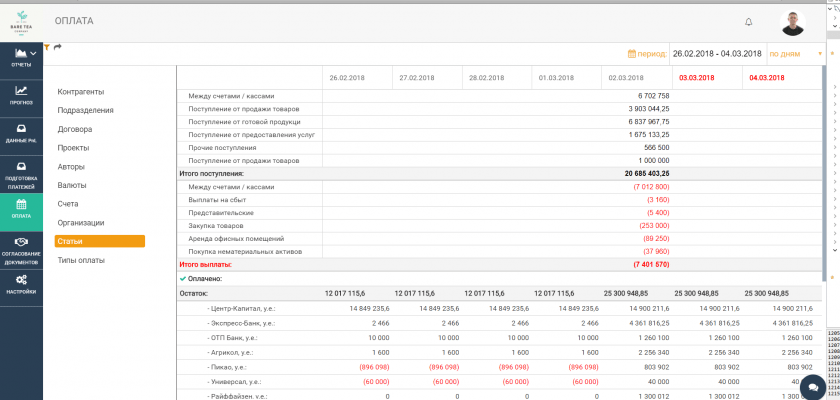

Chapter “Payment” in ABM Finance

3. Manage your payments.

You are faced with the task of postponing the payment of funds as much as possible. How can you do this?

- Make full use of the loan repayment terms. If a payment is due in 30 days, don’t pay it 15 days later.

- Use electronic funds transfer to make payments on the last day.

- Communicate with your suppliers so they know your financial situation. If you ever need to postpone a payment, you will need their trust and understanding.

- Carefully consider vendor offers of early payment discounts. You may come across some tricky conditions when you look deeper.

- Don’t always focus on the lowest price when choosing suppliers. Sometimes more flexible payment terms can have a better impact on your cash flow than a favourable deal price.

4. Learn to “survive” if you run out of money

Sooner or later, you may face a situation where you need to pay your bills and have no free cash. This does not mean that you are a bad manager, but only confirms the fact that no one can predict the future. That’s why there are adequate modern practices that help you competently survive a period of cash shortage. The most important thing is to realise that the problem exists as early as possible and to take the following actions.

- Allow the banks to understand that you are a conscious client and know beforehand that you will need extra money.

- Open your own credit line in a bank.

- Ask suppliers for a delay of payment, they may know your business, and sometimes they are even more interested in your financial stability than you are.

- Get rid of unnecessary stocks, equipment, old products for any money that you are offered.

Using these tips, you can build a high-quality cash flow management system, but that’s not all. Today, there are cloud-based applications for creating a payment calendar and automating corporate treasury.

One of these programmes is the ABM Finance system, which provides:

- transparent money management. All payments are “in full view”;

- automatic control of key risks;

- timely fulfilment of suppliers obligations;

- credit load reduction;

- managed liquidity;

- prompt and transparent reporting.

Still not sure whether you need treasury automation? Leave a feedback request and we will get back to you as soon as possible. We will show you all the benefits of this solution and discuss the specifics for your business during a personal demonstration.