Inventory Management in Retail: How to Calculate Key Performance Indicators

Calculating and analyzing KPIs in inventory management provides insight into where money is concentrated in the supply chain. Often, funds remain tied up in excess inventory at warehouses and retail locations, or retailers lose customer loyalty and miss out on profits due to lost sales.

Inventory management in retail comes down to balance: achieving product turnover while maximizing demand satisfaction. It is essential to monitor key performance indicators to understand where money is invested and how quickly it will return as profit.

Our experience shows that few retailers know their KPIs in inventory management or can calculate them accurately.

Let’s take a closer look at which metrics to focus on and how they impact sales and profitability.

6 Key KPIs in Inventory Management

How effectively are you managing your inventory? To answer this question, it is essential to regularly track and analyze the following metrics:

- Inventory

- Sales

- Excess stock

- Lost sales

- Availability percentage

- Inventory turnover

The Role of Inventory in Business Profitability and What You Need to Know to Calculate the Metric

Inventory is a key asset for retailers.

To ensure a seamless sales process, it is not only necessary to display products in-store to showcase the assortment but also to maintain sufficient stock levels in the warehouse. It is important to understand how many units of each category are available, how much needs to be reordered, and how to do this in a timely manner.

Inventory is a constantly changing metric, so it should be monitored over time. For example, this can be done by comparing it to the previous week, month, or year. Another method is a like-for-like comparison, which involves comparing similar metrics for the same period in the past.

In addition to tracking changes in inventory levels, it is also essential to assess their structure. This approach helps to identify where money is invested and how to avoid unforeseen expenses and losses.

The inventory structure in retail is divided into three main categories:

- Money invested in inventory for sales

- Money invested in inventory for shelf display and safety stock

- Excess inventory

The ABM Inventory management system allows for the creation of specialized reports that clearly illustrate the inventory structure in terms of both value and quantity.

In our clients’ practices, there have been cases where poor inventory turnover was observed despite the absence of excess stock.

By analyzing the reports on inventory structure, we were able to identify the cause: the value of inventory for sales and for merchandising display was approximately equal, which significantly—and artificially—inflated the turnover rate.

This issue has a solution: to improve turnover, it is sufficient to reduce the display of certain SKUs on the shelves in a number of stores.

Sales Orientation

One of the key KPIs in inventory management is sales.

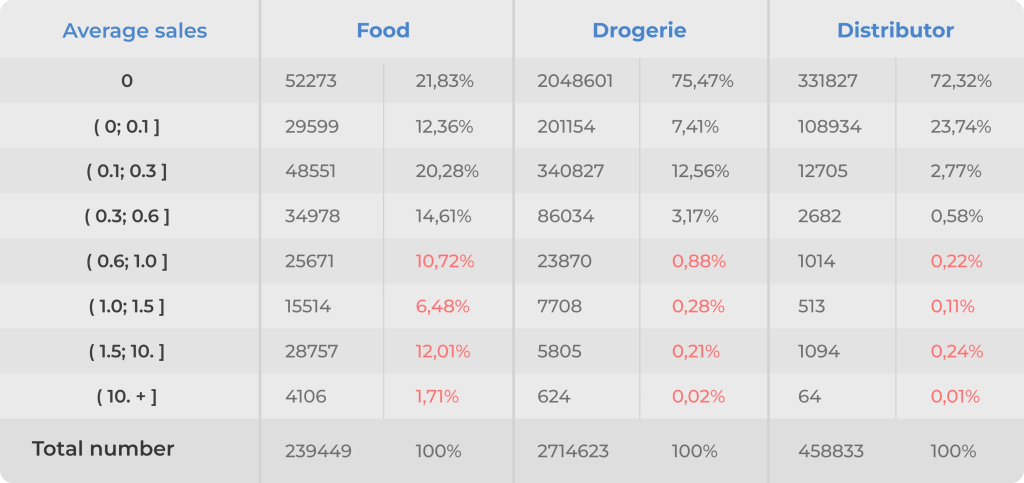

It is also important to consider the sales metric in terms of its structure. A small study we conducted among our clients revealed several demand characteristics and how they impact this KPI.

In the first column of the table, the average daily sales are categorized by intervals. Products with a turnover rate of over 0.6% per day are classified as high-turnover items.

When examining various retail sectors, even in the food category, only 30% of sales come from high-turnover positions. In categories such as drogerie, health & beauty, toy retail, and automotive parts, the majority of products fall under the low-turnover category.

This indicates the importance of focusing on these positions and working strategically with them. The cost of errors in managing low-turnover items with high demand variability can lead to significant profit losses.

The ABM Inventory system features a special algorithm that specifically addresses slow-moving items with high demand variability.

Regular assortment analysis allows for timely tracking of which items have fallen out of favor and investigating the reasons behind this. In some cases, it makes sense to remove these products from the assortment matrix. For instance, at one of our clients’ retail locations, after conducting an ABC(D) analysis, the assortment was systematically cleaned of D-category products. This decision resulted in a 56% increase in sales without a significant rise in inventory levels.

How to Calculate Excess Inventory and What to Do If It Grows

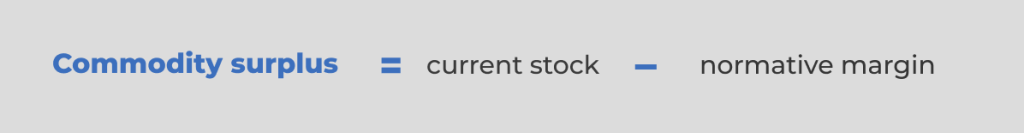

The next key performance indicator in inventory management is excess inventory.

It’s crucial to analyze the reasons for excess stock to prevent similar situations in the future.

If excess inventory does occur, you need to determine how to handle it with minimal losses to the business.

Three Main Strategies for Managing Excess Inventory

The first strategy is to return excess inventory to the supplier. Unfortunately, this option is not legally permitted in all countries or for all categories of goods. If you have the opportunity to do so, it is advisable to take advantage of this option.

The second strategy involves running promotional campaigns to sell excess stock. However, if the excess was not generated through promotions where the purchase price was lower, this could negatively impact the margin, potentially reducing it to zero or even resulting in a loss. When choosing this strategy, it is crucial to understand the overall picture and select options with the least risks while weighing the benefits for each retail location.

The third strategy involves transferring excess inventory between retail locations or returning it to the central warehouse. Before selecting this option, it is essential to analyze the structure of the inventory and excess stock, as well as assess the needs of the retail location to which the transfer is being made.

Why Do Lost Sales Occur and How to Calculate This Metric

The fourth KPI in inventory management is lost sales, which arise due to stockouts in the warehouse.

Lost sales can be triggered by various factors, including partial or complete supply failures from suppliers, lack of parameters for generating orders, sudden spikes in demand for specific product groups, and other reasons.

Often, lost sales occur as a result of a combination of these factors. It’s crucial to identify the most frequent cause and focus on addressing it to increase product availability and, consequently, sales volume.

Many clients express skepticism in negotiations, stating that lost sales are a hypothetical figure. Why spend time calculating it? Indeed, obtaining an exact number can be challenging due to the nature of this metric. However, this does not mean that one should completely disregard lost sales when analyzing the effectiveness of inventory management. Here’s why.

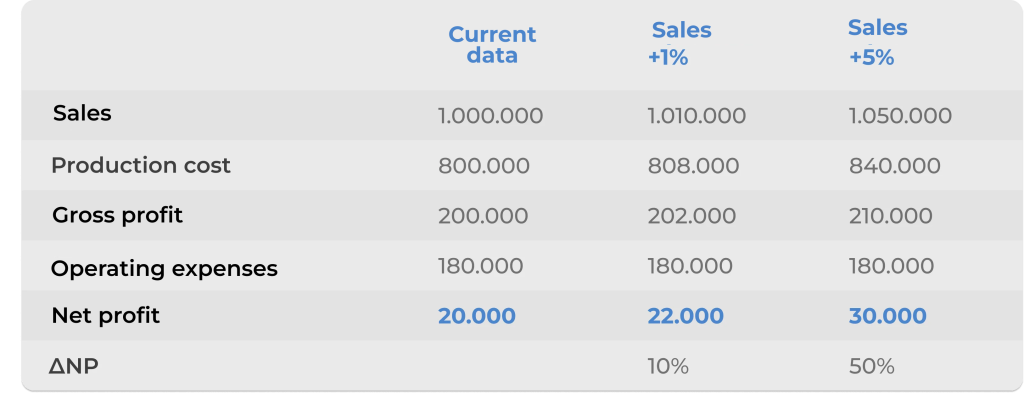

Suppose that as of today, the performance indicators of your retail location match the figures in the “Current Data” column. What would happen if you increased sales by 1% by addressing lost sales, while keeping operational expenses at the same level?

As we can see from the table presented, this would lead to a 10% increase in net profit. The third column illustrates the impact of a 5% increase in sales. Not bad, right?

Of course, this is a simplified calculation, and in real life, many factors influence the outcome. However, it demonstrates how lost sales correlate with profit margins. If there’s a way to increase profits, why not take advantage of it?

In the ABM Inventory system, there is a dedicated report on the statistics and reasons for lost sales, which shows changes in this metric over time, both for individual product categories and for groups. Analyzing this data helps identify the root causes of problems and seek solutions.

The report also provides statistics on lost sales by each manager and/or retail location. This is an important criterion for analysis, as human factors also impact sales. It helps clarify the situation and answer the question: why didn’t the customer find the desired product on the shelf?

Availability of Goods: What This Metric Indicates

Another important KPI in inventory management is product availability.

The percentage of product availability indicates the completeness of the assortment matrix and allows businesses to determine how much stock is on hand. This metric is evaluated across different categories within the network, suppliers, and the managers responsible for inventory management.

What You Need to Know for Calculating Inventory Turnover

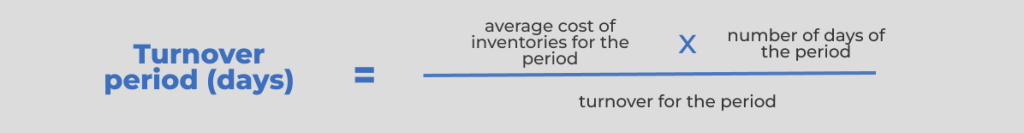

The sixth performance indicator is inventory turnover, which reflects the relationship between stock levels and sales in the retail network.

Inventory turnover is a relative measure, and it is often analyzed by network or category.

For instance, if the turnover for a network is 22 days and suddenly increases to 26 days under otherwise unchanged conditions, this is a signal to investigate the reasons behind such a significant rise in the metric.

With one of our clients, we managed to reduce inventory turnover by 14% in three weeks without increasing logistics costs, thanks to targeted efforts in reallocating excess stock.

The lack of algorithms and a systematic approach to calculating key performance indicators (KPIs) in inventory management leads to forecasts of risks that do not reflect reality. As a result, the business incurs losses.

If you are not currently measuring these metrics, it is time to reconsider your approach to inventory management. Implementing an automated system allows for the quick assessment of any changes, reduces the time required to create orders, and provides comprehensive analytics across various criteria.