Finance BPM Functionality

AI-Driven Automation

Payment and Liquidity Management

Business Processes and Approvals

Documents, Data, and Analytics

Security and Infrastructure

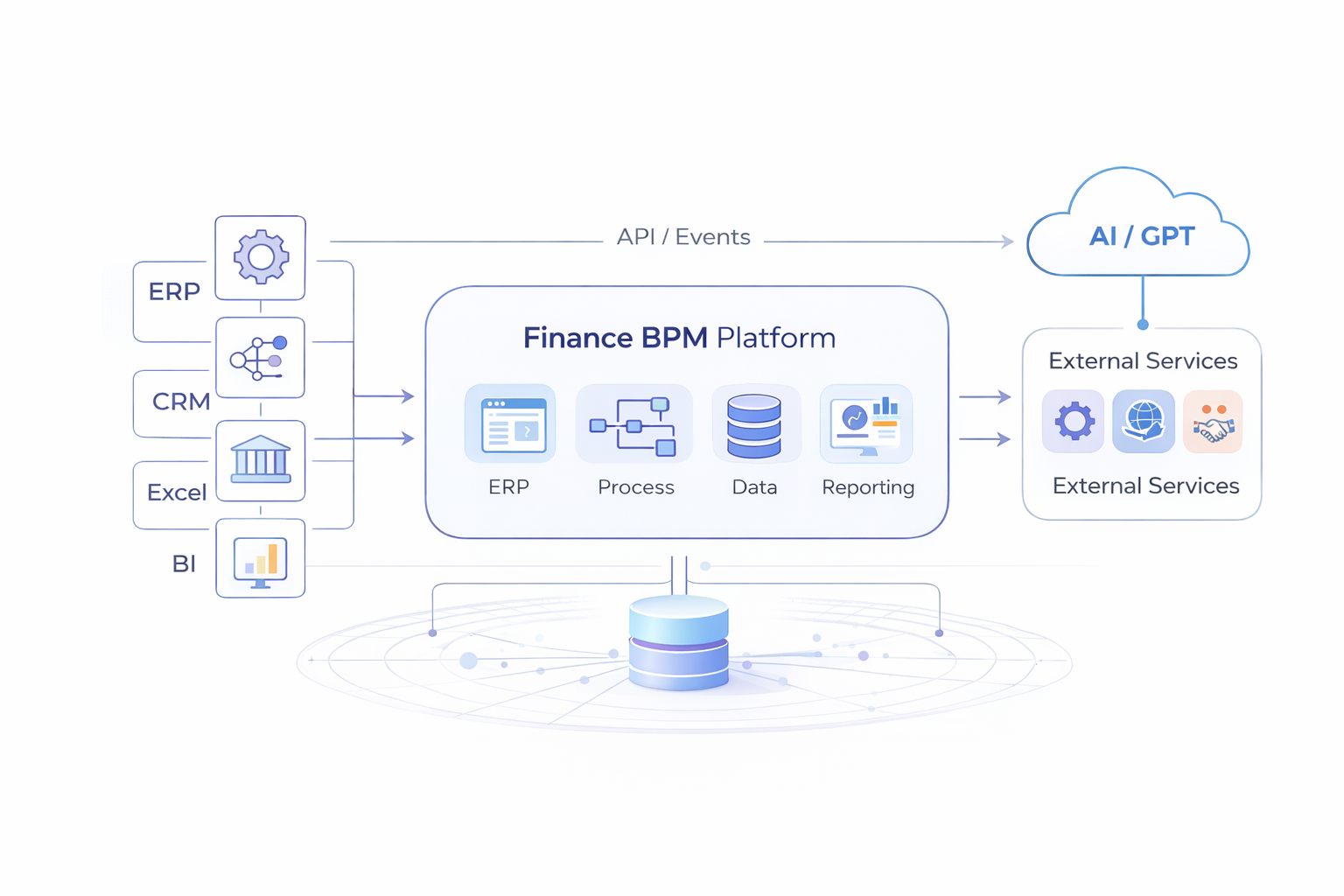

Integrations and Ecosystem

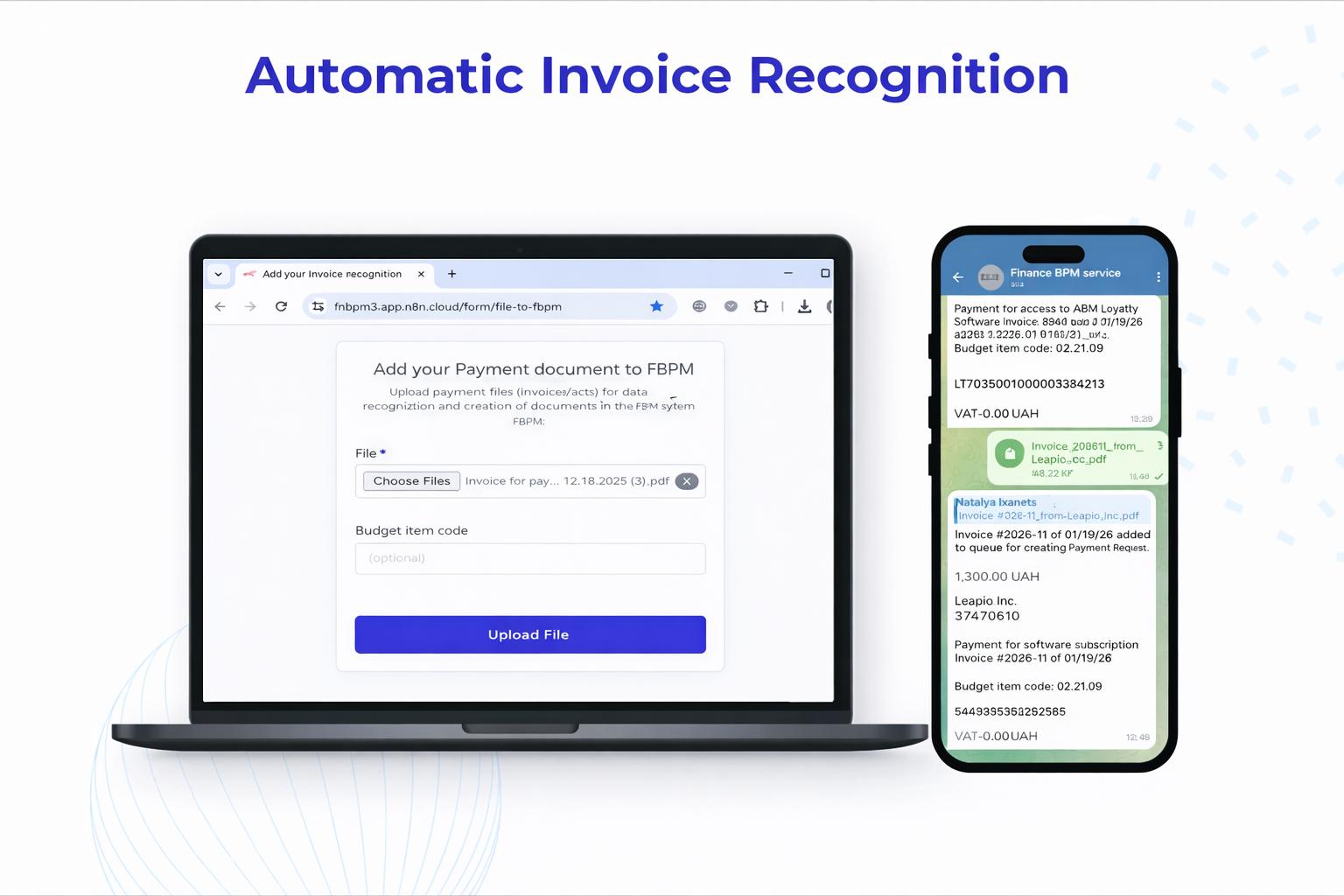

Invoice Recognition and Request Creation

-

Request and Invoice Processing

Document analysis, identification of counterparties, VAT, amounts, and budget categories

-

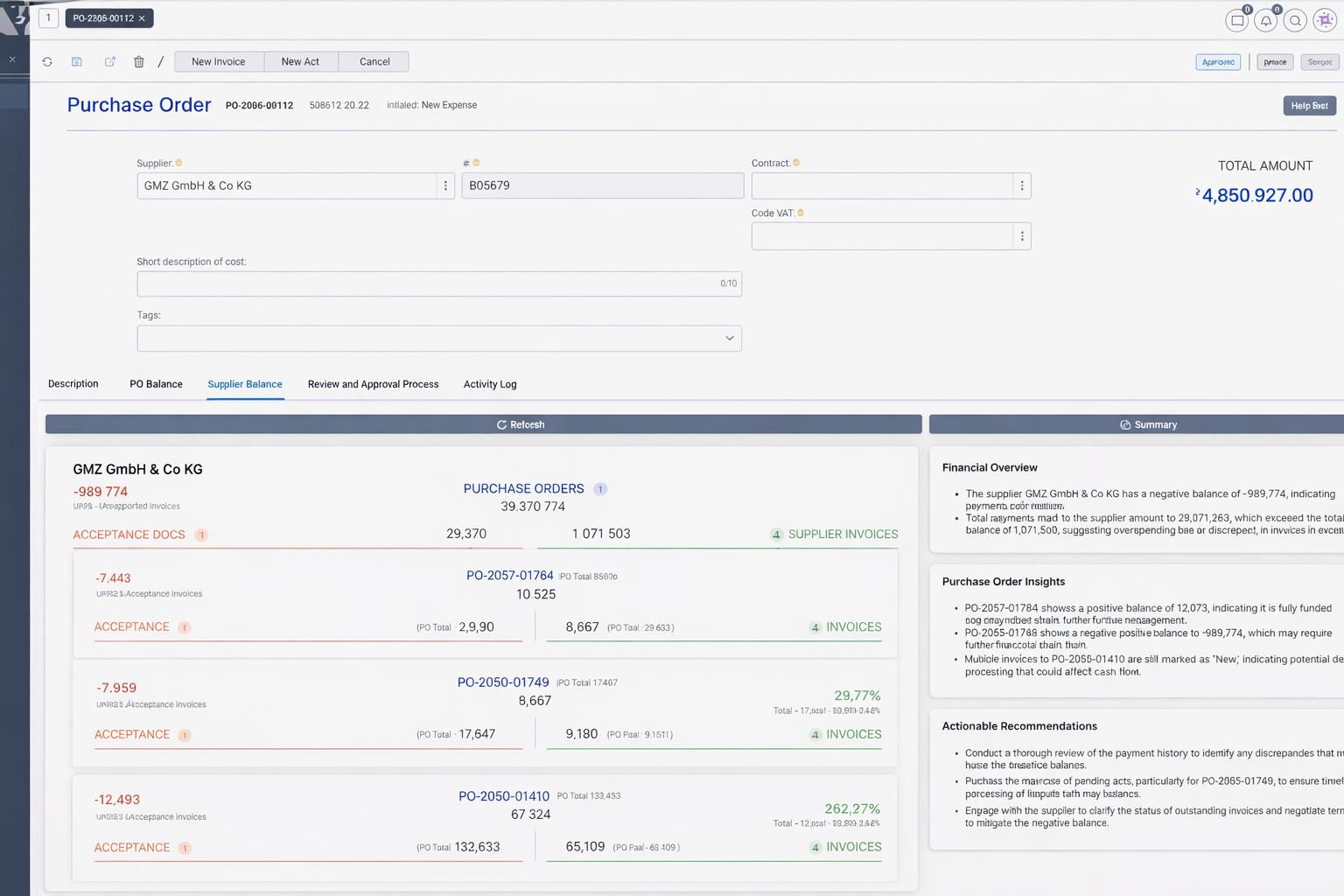

Counterparty analysis and risk forecasting

Evaluates the history of cooperation, outstanding balances, and payment discipline to build a counterparty risk profile

-

AI Technical Support Assistant

Provides recommendations on which metrics to focus on and suggests actions based on financial analytics

-

Detection of errors and anomalies in data

AI automatically detects inaccuracies, duplicates, and deviations from standard templates, helping to prevent financial errors

-

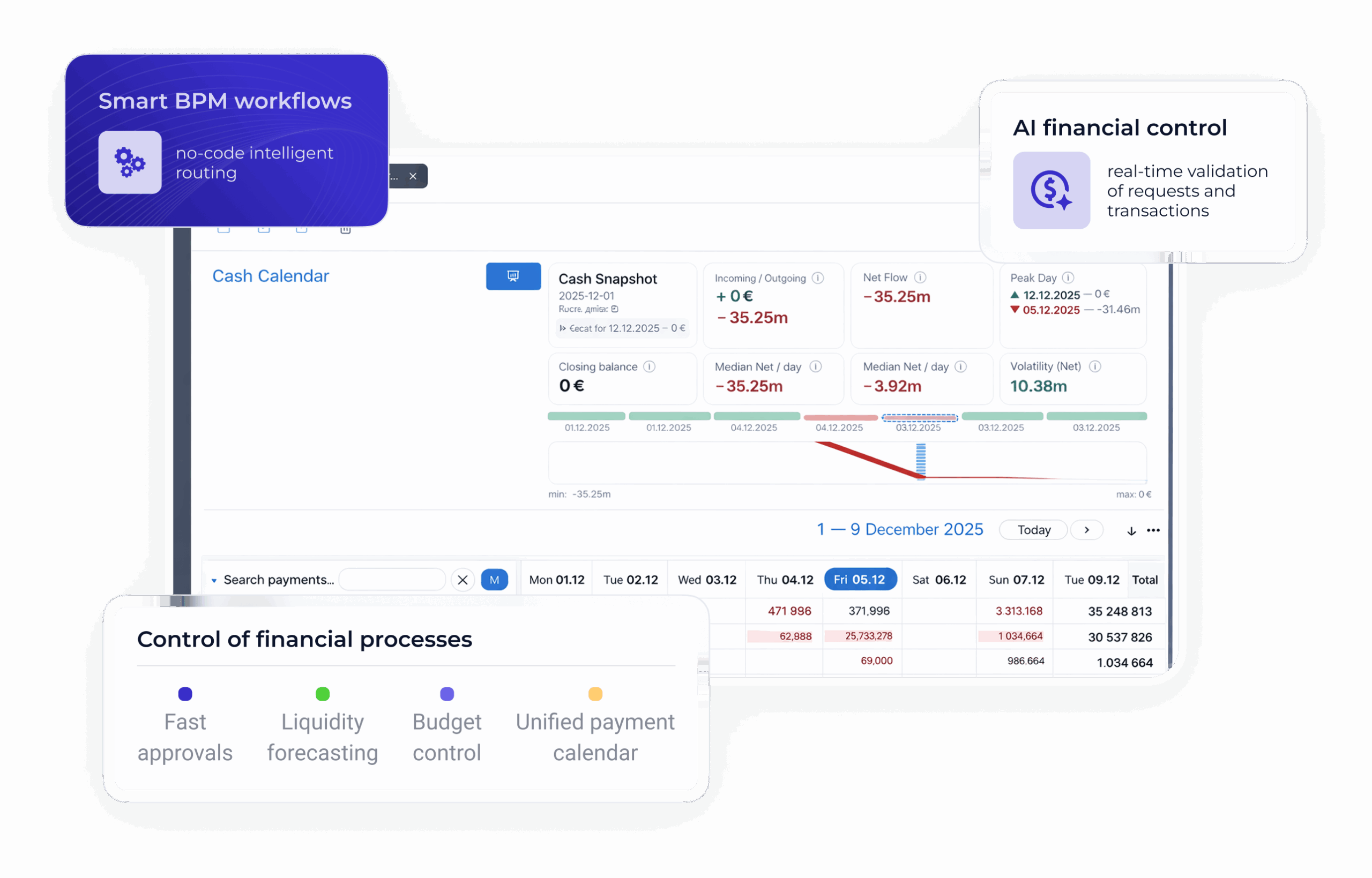

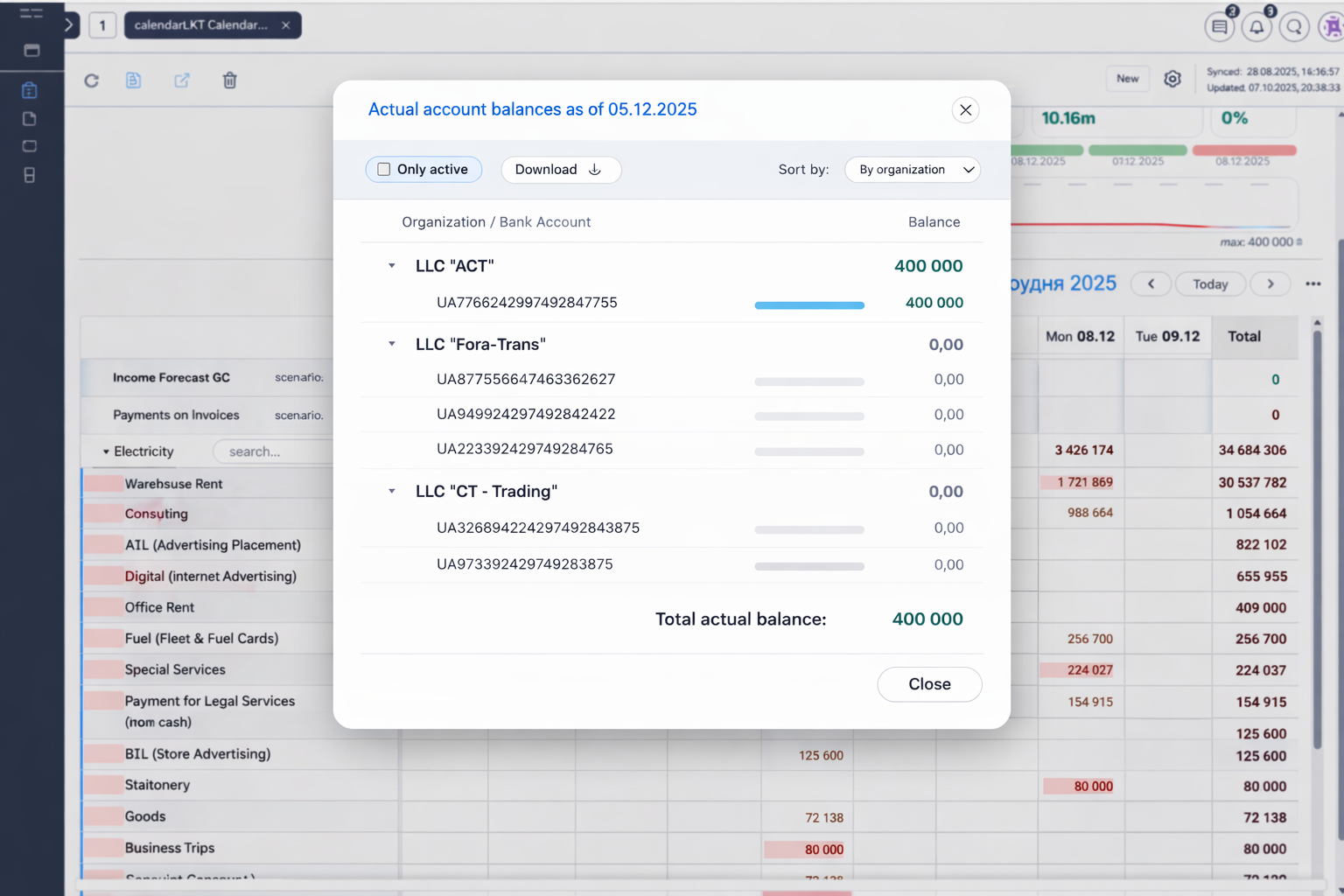

Unified Payment Calendar

Displays all scheduled payments, receipts, and balances at a defined frequency, across multiple analytical dimensions: budget items, projects, cost centres, counterparties, legal entities, and departments

-

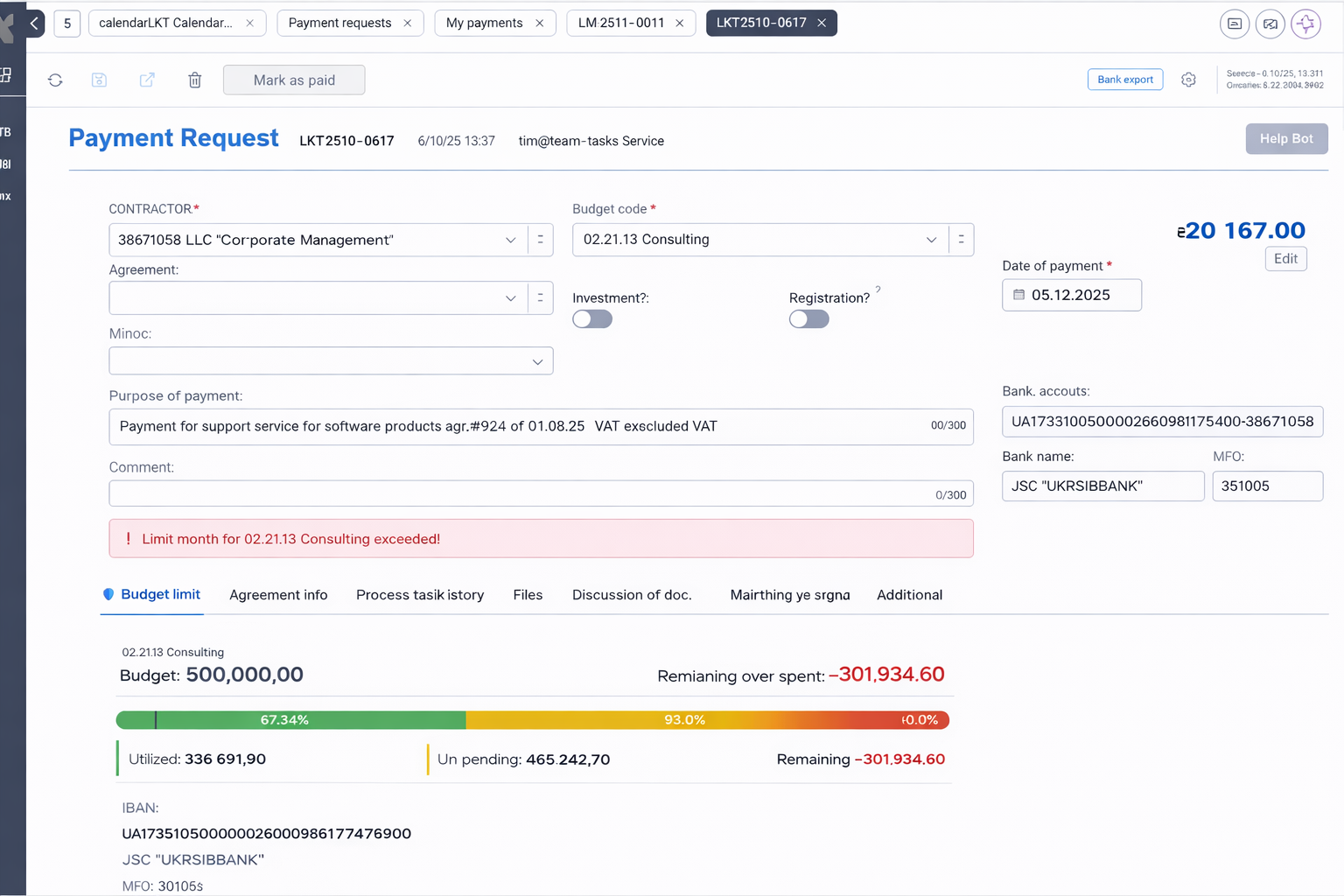

Payment Requests and Budget Limit Control

Builds the payment calendar based on requests. Forecasts incoming funds, automatically checks budgets and blocks overruns, and enables direct export of payments to the bank from the calendar

-

Automatic Matching of Planned and Actual Payments

Plan vs Actual Analysis with Detailed Variance Explanations

-

Liquidity and Cash Gap Analytics

Cash flow forecasting and management of payment rescheduling to avoid cash gaps

-

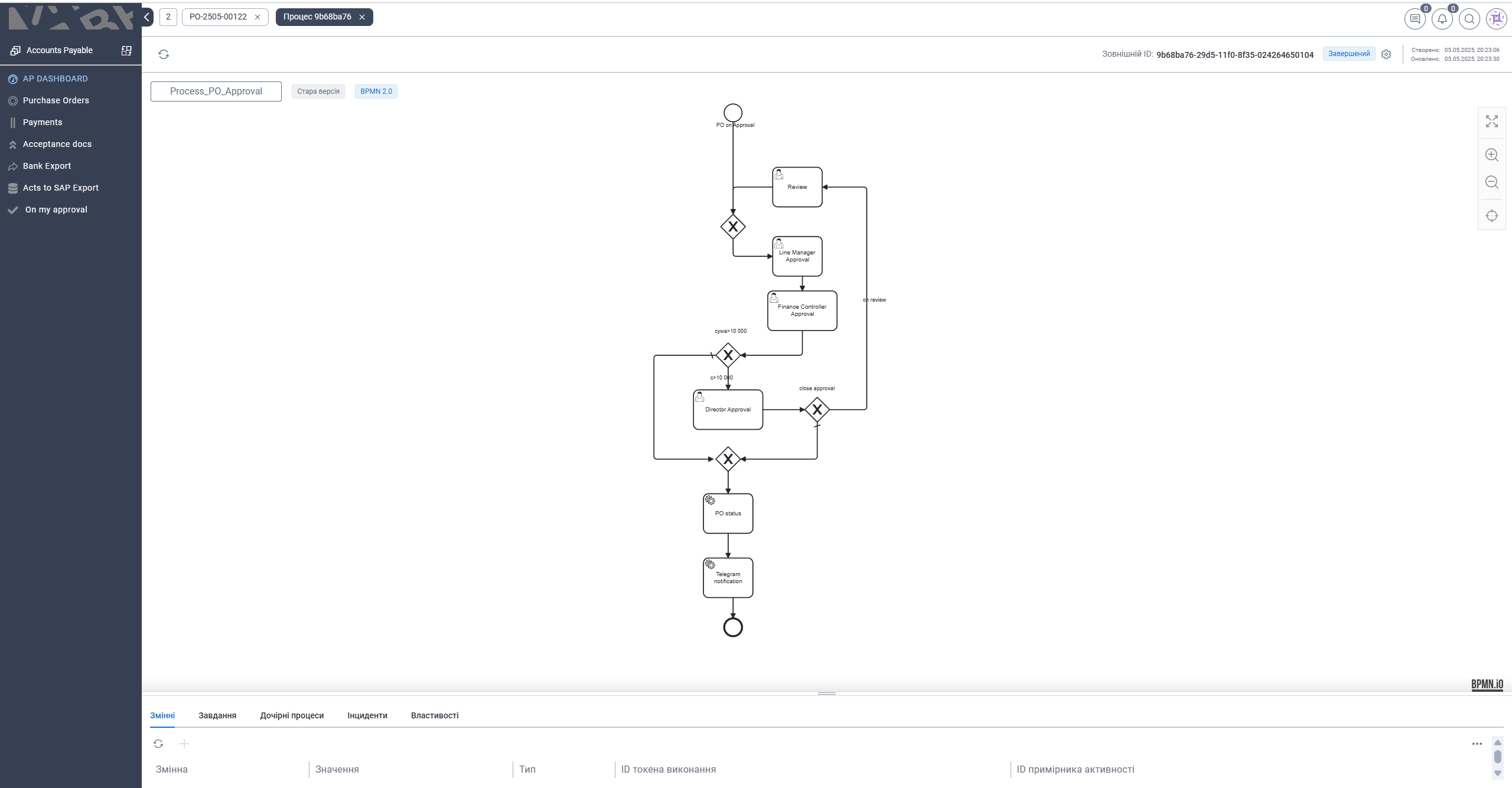

No-Code BPMN Process Builder

Business process modelling of any complexity, standardised in accordance with BPMN and DMN, and equally clear to both business users and IT systems

-

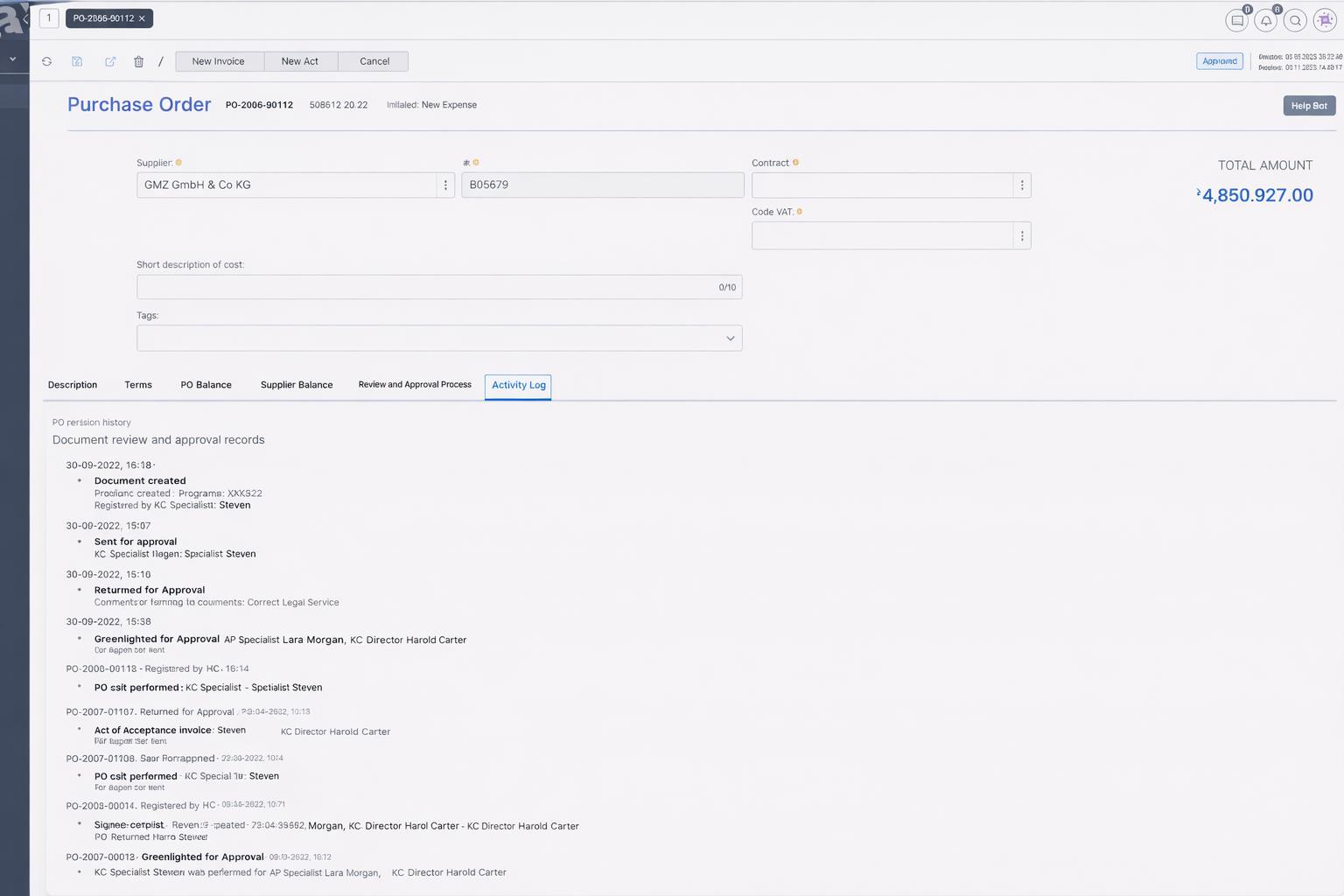

Flexible Approval Workflows

Approval scenarios based on roles, amounts, budget items, and conditions, while maintaining full transparency and a complete audit trail

-

Control at Every Stage

Automatic validation of data accuracy and compliance with internal company policies

-

Automated Notifications and Triggers

Instant notifications about any process changes — tasks, updates, and deviations

-

A convenient document repository with intelligent search

Quick access to files by name, content, and metadata

-

AI Document Summaries

Automatically generates a concise summary of the document for quick understanding of its key points

-

Comprehensive Counterparty Analytics

Settlement history, debt structure, and inflow dynamics

-

Dashboards and Detailed Reports

All key analytics with drill-down to the transaction level

-

Single Sign-On and Data Protection (SSO, TLS, Encryption)

Secure authentication via OAuth 2.0 / OpenID Connect (Azure AD, Keycloak). Data encryption in transit and at rest, with passwords stored as bcrypt hashes. Optional encryption of sensitive data

-

Flexible Access Management

Granular role-based access control (RBAC): roles, organisations, and individual rules. Access restrictions down to the entity, record, or even field level

-

Full Audit and Logging

Logging of all user actions, including logins, data changes, document views, and process transitions.

Compliance with corporate security standards (SOC 2, ISO 27001) -

Monitoring and Fault Tolerance

System monitoring (Prometheus, Grafana), centralised logging (ELK), and backups. Risk alerts, performance monitoring, and stability tracking

-

Integrations with ERP, CRM, and BI Systems

Connection to accounting and analytics systems via APIs and standard connectors. Data synchronisation with SAP, Microsoft Dynamics, Power BI, Odoo, and other systems without manual duplication

-

Unified Financial Model

Consolidation of data from multiple systems into a single financial framework, enabling work with one consistent, up-to-date version of the data

-

Scalability and Growth Readiness

Support for multi-company structures, cost centres, and holdings. The system scales as your business grows

-

Sending invoices in PDF format

Sending invoices in PDF format directly via Telegram, email, or a secure link

-

OCR and AI-Based Data Recognition

The counterparty, amount, VAT, date, invoice, and payment purpose are automatically identified

-

Intelligent Budget Category Selection

AI reduces errors and manual effort for the finance team

-

Automatic Request Creation in Finance BPM

The completed request is immediately submitted into the approval workflow

Helping businesses automate their financial systems

Agriculture

Development and Construction

Pharma

Food & Beverages

Media

Transportation and Logistics

Energy

Food Industry

IT Industry

Results of Using Finance BPM

Centralised Financial Management

All financial processes, payments, budgets, and documents are unified within a single framework. This eliminates data fragmentation, simplifies control, and provides a holistic, real-time view of the company’s financial position

Budget Transparency and Control

Automatic limit control, plan vs actual analysis, and a complete change history enable timely identification of variances and help prevent overspending at the approval stage

Real-Time Cash Flow Management

The payment calendar and liquidity forecasting provide control over inflows and outflows across all companies, accounts, and periods, reducing the risk of cash gaps

Fast Payment Approval and Execution

Automated approval workflows, triggers, and notifications shorten the request approval cycle and enable payments to be executed significantly faster without losing control

Reduced Manual Work and Errors

AI-driven document recognition, automatic budget category selection, and checks at every stage minimise human error and reduce the number of financial mistakes

Scalability and Growth Readiness

The system easily adapts to complex structures, groups of companies, and holdings, supporting business growth without the need to redesign financial processes

We appreciate your interest in our products. An ABM Cloud representative will be in touch with you shortly. Have a great day.

Common Questions

Who is Finance BPM suitable for?

The system is designed for medium and large organisations that need to centralise financial management, control budgets, and manage payments transparently across multiple legal entities or business units.

How is Finance BPM different from traditional financial systems?

Unlike traditional solutions, BPM combines business process automation with financial control. It is not just an accounting tool, but a decision-support system with a built-in AI assistant.

Can Finance BPM be integrated with our accounting systems?

Yes. The platform integrates with ERP, CRM, BI solutions, and accounting systems (such as SAP, Microsoft Dynamics, Odoo, etc.) via APIs or ETL gateways.

Which processes can be automated?

All key financial scenarios: request creation and approval, budget control, payment calendar management, liquidity forecasting, and actual vs. plan reporting.

What role does artificial intelligence play in the system?

AI modules assist in verifying requests, selecting journal entries, detecting anomalies in payments, forecasting cash flows, and recommending optimal actions.

Is it possible to customise processes to fit our structure?

Yes, the BPM mechanism allows you to create custom approval workflows, access rights, controls, and document templates without coding — simply through the administrator interface.